Gold Is Co-Accused If CAD Is High

Market participants in last few months have raised questions on India’s macro- economics and have tried to revive memories of 2013 “Fragile Five“. While there is no denial that recent macro-economic developments like sharp currency depreciation (including a sharp fall in REER), sustained FII outflows, slowing global trade amid tariff uncertainty, and a surge in gold prices (and gold imports) have all contributed to concerns that India’s current account deficit (CAD) could widen materially and push the economy into a vulnerable macro position, and has revived memories of the 2013 “Fragile Five” .

We clearly dispute this through detailed analysis of our CAD over last few years. India’s current account today is anchored on a far stronger and more diversified foundation than in 2013. A decade of structural reforms bolstering our domestic manufacturing capabilities and global competitiveness, a services-led export engine, resilient remittance inflows, and record foreign-exchange buffers have significantly reduced external vulnerability. As a result, a closer look at the underlying composition of the current account suggests that headline volatility is masking meaningful improvements in the quality, resilience, and sustainability of India’s external balances.

1. Headline CAD masks a structurally stronger external balance

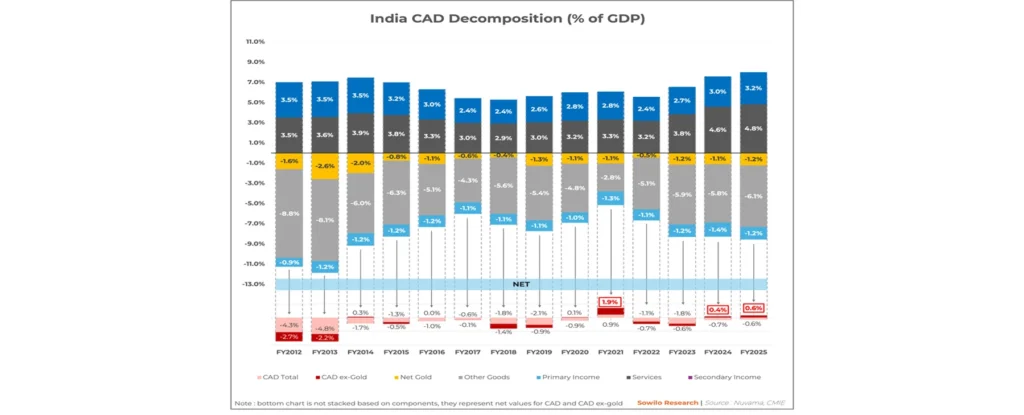

India’s CAD has narrowed sharply over the past decade—from 4.8% of GDP in FY13 to just 0.6% in FY25. More importantly, this improvement is not merely cyclical, but compositional.

- Ex-gold, the current account has been in surplus for two consecutive years, underscoring that gold remains the principal swing factor rather than broad- based import dependence.

- Non-gold goods defficit has structurally compressed, reflecting import substitution, localization of manufacturing, and gradual movement up the value

- Services exports have strengthened materially, rising from ~3.5–3.6% of GDP in FY12–13 to ~4.8% in FY25, providing a stable and recurring offset to the goods

- Secondary income (remittances) has remained resilient at ~3% of GDP, acting as a natural stabilizer even during periods of global

This is a sharp contrast to 2013, when India was running a large, broad-based goods deficit with weaker services exports and limited buffers to absorb external shocks.

2. Services exports are now a structural pillar of the current account

The single most important structural shift in India’s external balance since 2013 has been the scale, diversiffication, and durability of services exports.

- IT and software services form the backbone, with exports of ~$224 billion in FY25 (NASSCOM data). The sector employs ~5.8 million professionals, led by global-scale firms such as TCS (~$30bn revenue), Infosys (~$19bn), and HCLTech (~$14bn).

- Export exposure is concentrated in high-quality, sticky markets, with the US absorbing ~54% of IT exports, and UK + Europe another ~31%, ensuring scale, pricing power, and resilience.

- Global Capability Centres (GCCs) represent the next structural growth driver. India now hosts 1,800+ GCCs, employing ~2.1 million professionals and generating ~$65 billion in annual revenue. New GCCs are being established at a pace of ~one per week, with ~110 additions in FY24–25 alone. Major multinational operations include Goldman Sachs, JPMorgan Chase, Google, and The GCC ecosystem is projected to scale to $100–150 billion by 2030, further embedding services exports as annuity-like inflows.

This services-led surplus fundamentally alters the CAD risk profile and explains why India’s current account today is far less sensitive to goods trade volatility than it was a decade ago.

3. Structural reforms are now leading to tangible and quantiffiable results

The evolution of India’s current account over the last 13 years reflects cumulative structural reform rather than short-term policy responses.

- Initiatives around Atmanirbhar Bharat, PLI schemes, and targeted import substitution have reduced reliance on low-value and discretionary imports.

- Domestic manufacturing depth has improved, shrinking the “other goods” deficit from ~8–9% of GDP in FY12–13 to ~6% in FY25.

- The services export engine—IT services, GCCs, business services, and digital exports—has become broader and more resilient, lowering sensitivity to global trade cycles.

As a result, even if gold imports spike episodically, the core current account position remains structurally defensible.

4. Improving global trade positioning limits downside risk

Concerns around global trade fragmentation are valid, but India’s external engagement today is far more diversified and pragmatic.

- India has strengthened trade and strategic partnerships with the US, EU, and UK, while also witnessing gradual normalization in economic engagement with China after years of stalled dialogue.

- Recent steps such as faster visa issuance for Chinese engineers, bilateral engagements, and selective import duty rationalization point to calibrated economic pragmatism rather than

- Over time, this should support supply-chain integration, cost efficiencies, and potential moderation in the non-oil goods deficit.

India’s trade policy today is therefore more flexible and opportunity-driven, reducing the risk of a sudden and disorderly deterioration in the current account.

5. Record FX reserves provide strong external buffers

Any discussion on CAD sustainability must be anchored in India’s external buffers.

- India’s foreign exchange reserves reached an all-time high of ~$709 billion in January 2026, ranking 4th globally, behind only China, Japan, and

- This provides 11+ months of import cover, nearly four times the IMF’s recommended minimum of three months, offering substantial protection against external shocks, capital flow volatility, or temporary CAD

In 2013, limited reserves amplified stress and forced sharp policy tightening. Today, reserve adequacy allows the RBI to smooth currency volatility without compromising macro stability, fundamentally altering India’s external vulnerability.

Bottom line

While elevated gold imports can widen the CAD optically in the near term and exert some pressure on the currency, India’s external vulnerability today is materially lower than in 2013. A narrow headline deficit, surplus ex-gold position, structurally strong and growing services exports, resilient remittances, improved trade diversification, and record FX buffers make the current account a variable to be managed, not a constraint on macro stability. It is no longer a structural fault line for India. Sowilo is the SEBI Registered Best PMS Company in Mumbai

Regards, Team Sowilo

DISCLAIMER: Any information contained in this material represents Sowilo’s views and research analysis and shall not be deemed to constitute an advice, an offer to sell purchase or as an invitation or solicitation to do for security of any entity and further Sowilo Investment Managers LLP and its employees/directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use of this information. Sowilo Investment Managers LLP – SEBI Registered Portfolio Manager (INPO00008127)